Starting a business in Jebel Ali Free Zone (JAFZA) can feel overwhelming. Did you know that Jafza is the largest customs-bonded zone in the Middle East? Explore the process of Jafza company setup, including choosing a license and completing the registration.

Exploring JAFZA Free Zone

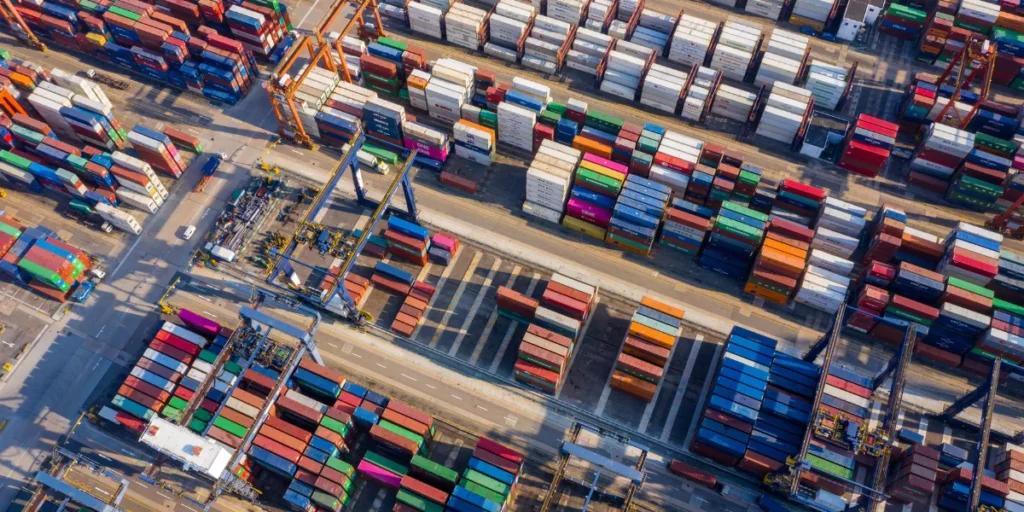

Jebel Ali Free Zone Authority (JAFZA) serves as the flagship free zone of DP World. It is the largest customs-bonded zone in the Middle East. The area connects around 3.5 billion people, making it a global business hub. JAFZA covers key industries such as Logistics, Petrochemicals, Oil & Gas, and Food & Agriculture.

Key sectors supported by JAFZA include Retail & E-Commerce and Manufacturing. Notably, its electronics hub accounts for over 50% of Dubai’s electronics trade volume. In 2019, the automotive sector marked a growth rate of 6%. This showcases why companies seek to set up their Free Zone businesses here.

Company Formation Options in Jebel Ali Free Zone

JAFZA offers several ways to set up a company in largest Free Zone. Each option fits different business needs and goals.

Setting Up a Free Zone Establishment (FZE)

Setting up a Free Zone Establishment (FZE) allows businesses to operate in JAFZA. An FZE can have one shareholder, which could be an individual or a company. Before 2017, the minimum share capital required was AED 1,000,000*. Now, no minimum capital is necessary.

To establish an FZE, gather and submit all required documents like your business plan and lease agreement. Comply with UAE laws such as Ministerial Decision No. 100 of 2020. This rule requires companies to file an Economic Substance Report each year. Make sure you understand all rules and regulations before starting the registration process for your FZE.

Establishing a Free Zone Company (FZCO)

Establishing a Free Zone Company (FZCO) in JAFZA is straightforward. An FZCO operates as a Limited Liability Partnership with liabilities limited to the paid-up capital. Shareholders can range from two to fifty, including both individuals and entities. Prior to 2017, each shareholder needed at least AED 500,000* in share capital.

To set up an FZCO, follow key steps like filling out the Ultimate Beneficiary Owner KYC forms and understanding rules and regulations. This ensures that all business activities comply with UAE’s commercial companies law. You must also submit required documents such as copies of passports and proof of address for all shareholders.

Forming a Public Listed Company (PLC)

A Public Listed Company (PLC) in JAFZA needs at least two shareholders. It lets you list your shares on a stock exchange. This means you can sell parts of your company to the public, raising more funds. Ensure your business license allows for manufacturing, trading, or services based on what your company will do.

PLC setup offers many advantages like access to more capital and greater visibility for your business growth. However, it also involves strict regulatory compliance and reporting requirements.

Launching a Branch of an Existing Company

A branch in Jafza must be fully owned by the parent company and operate under the same name. This means the parent company can control all activities of the branch. To set up, you need to start a new registration process since Jafza does not allow direct business transfers from mainland Dubai.

The branch benefits from tax exemptions and freedom of capital repatriation. It also gains access to strategic locations like Jebel Ali Port and Al Maktoum International Airport. The setup in Jebel Ali Free Zone allows companies to expand their reach while enjoying reduced regulatory hurdles.

Registering an Offshore Company

JAFZA offshore companies need at least one shareholder. 50 shareholders is the upper limit.

Then gather required documents for submission. This includes passports, proof of address, and a completed application form. Offshore companies benefit from tax exemptions. They also enjoy freedom from currency restrictions and full repatriation of profits.

Registration Process for Companies in JAFZA

The registration process in JAFZA involves several steps. You need to prepare documents and pay the required fees for business formation.

Pre-registration Checklist

Setting up a company in Jebel Ali Free Zone demands thoughtful planning. Leverage the expertise of a business setup consultancy like Xpert Advisory to streamline the process and ensure success. Follow this pre-registration checklist to get started.

- Define Business Activity

Decide what kind of business you want to run in JAFZA. This will help identify the appropriate type of license required for your specific business. - Choose Company Type

Pick between Free Zone Establishment (FZE), Free Zone Company (FZCO), or others like Public Listed Company (PLC). - Check Shareholder Requirements

Confirm the number of shareholders needed for your chosen company type. FZE needs a single shareholder, while FZCO can have multiple shareholders. - Prepare Necessary Documents

Gather all required documents such as the Memorandum and Articles of Association, passport copies, and NOC from current sponsors if applicable. - Understand Licensing Fees

Be aware of the licensing and registration fees involved in setting up your business. - Determine Office Space Needs

Decide whether you need office space, warehouse facilities, or both within JAFZA. - Plan Initial Setup Costs

Analyze initial costs carefully using tools like the JAFZA cost calculator to ensure you are financially prepared. - Review Regulations and Rules

Make sure to understand all rules and regulations set by JAFZA’s regulatory authority to avoid any compliance issues later on. - Confirm Trade Name Availability

Check if your desired company name is available for registration with the Dubai Trade authorities. - Assess Funding Sources

Plan how you’ll fund your setup costs and ongoing operational expenses. Consider options like foreign ownership benefits if applicable. - Draft Lease Agreement

Prepare lease agreements if leasing office spaces or warehouses under a sublessor-sublessee arrangement within JAFZA’s premises.

Required Document Submission

After completing the pre-registration checklist, the next step is to gather and submit the necessary documents. Each type of company formation in JAFZA has specific requirements.

- Application Form

Complete the JAFZA application form with all necessary business details to start your business and initiate your setup in JAFZA. - Business Plan

Provide a detailed business plan. This should outline your goals and business operations within the UAE. - Copy of Passport

Submit colored copies of passports for all shareholders, directors, and managers. Ensure these are valid. - Passport-Sized Photos

Offer recent passport-sized photos for each key individual involved in the company. - Proof of Address

Show proof of address for all shareholders and directors. Utility bills or bank statements from the last three months work best. - No Objection Certificate (NOC)

If an employee in another UAE-based company is involved, obtain an NOC from their current employer. - Bank Reference Letter

Get a reference letter from a recognized bank for each shareholder. - Board Resolution

Provide a board resolution stating the intent to establish the company in JAFZA. - Memorandum and Articles of Association (MOA/AOA)

Draft and submit the MOA and AOA detailing company structure and rules. - Manager’s Sample Signature

Give a sample signature of the manager on a white paper as part of identity verification. - Initial Capital Requirement Proof

Show evidence that you meet any minimum capital requirement for your chosen company type if applicable (especially for PLCs). - Economic Substance Report Compliance Confirmation

Confirm readiness to comply with Ministerial Decision No. 100 of 2020 related to economic substance reporting.

Adhering to this list will ensure a smooth document submission process for JAFZA company setup.

Understanding Licensing and Registration Fees

Understanding the licensing and registration fees in JAFZA is crucial. Fees vary based on your business type, size, and chosen facilities. For example, setting up a Free Zone Establishment (FZE) incurs different costs than launching a branch of an existing company. Generally, businesses pay for initial setup and annual renewal licenses.

JAFZA offers a cost calculator to estimate these expenses accurately. Using this tool helps in planning financials better. It’s essential to factor in both the one-time company formation fee and recurring fees like renewals. This ensures no surprises down the road.

Selecting the Appropriate JAFZA Business License

Choose the right Free Zone license within JAFZA to match your business needs and goals.

Acquiring a Trading License

A Trading License permits the purchase and sale of goods in JAFZA. To get this license, apply along with required documents such as a business plan and passport copies of the owners. Pay any licensing fees involved.

Once approved, your company can start trading within free zones like Jafza FZE. This license allows you to import, export, distribute, and store items in Dubai, UAE. Having a Trading License helps entrepreneurs take advantage of tax benefits in the region.

Obtaining a Service License

A Service License in JAFZA allows companies to offer services like consulting, IT, and other professional services. It is essential for any company planning to provide non-tangible goods. To obtain this license, you must first complete the application form on the JAFZA website.

Submit required documents such as passport copies, a business plan, and proof of address. Pay the necessary licensing and registration fees once all documents are verified. Afterward, your company will receive the Service License from JAFZA.

Securing an Industrial License

Securing an Industrial License in JAFZA is key for businesses aiming to set up a manufacturing facility. Submit your completed application form along with all necessary documents, such as copies of passports and business plans. Pay the required licensing fees during this process.

After submission, authorities review the application. Upon approval, you will receive the Industrial License. This allows you to begin operations in the Free Zone.

Choosing a Logistics and Supply Chain License

A Logistics and Supply Chain License in Jafza is vital for businesses handling goods. This license covers activities like storage, shipping, and distribution. It helps you manage transportation networks effectively.

To acquire this license, submit your application to the Jafza Authority. You need relevant documents such as your company registration details and business plan. Having a Logistics license opens doors to operate within the free zone seamlessly.

Advantages of Business Setup in JAFZA

JAFZA offers many perks, making it an attractive choice for businesses. Companies can benefit from its key location and tax savings.

JAFZA’s Strategic Location Benefits

Jebel Ali Free Zone, the flagship free zone of Dubai, stands as a global hub for business and trade. JAFZA sits near the Jebel Ali Port and Al Maktoum International Airport. This location boosts access to global markets. Companies can easily import and export goods through these major hubs.

Located in the United Arab Emirates, JAFZA connects Europe, Asia, and Africa. Businesses enjoy efficient logistics and faster shipping times. This makes trading easier for companies with an international reach.

Tax Exemption Perks in JAFZA

Companies in JAFZA also enjoy great tax perks. Businesses there do not pay any income taxes or corporate taxes. This means more profit stays with the company.

There are no import or export duties in JAFZA either. Companies save money on goods moving in and out of the zone. These perks make JAFZA a hot spot for business owners from all over.

Freedom of Capital Repatriation in JAFZA

JAFZA stands out with its policy on capital repatriation. Businesses can transfer profits and capital back to their home country without any restrictions. This offers companies, including limited liability companies (LLCs), a lot of financial flexibility.

This freedom attracts global investors who seek full control over their earnings. Many choose JAFZA for this reason alone. It helps in clear financial planning and boosts investor confidence.

Facilities Requirements in JAFZA

JAFZA offers a variety of office spaces and warehouses to meet different business needs. Read on to explore more about the business facilities available!

Office Space and Warehouse Options

Office space and warehouse options in JAFZA cater to diverse business needs. Different types of facilities are available to help companies start and grow.

- Office Space

- Flexible office sizes: Choose from small, medium, or large offices.

- Fully furnished options: Offices come with furniture and necessary equipment.

- High-speed internet access: Enjoy reliable, fast internet for smooth operations.

- Meeting rooms: Book meeting spaces for client discussions or team meetings.

- 24/7 security: Offices are secure around the clock.

- Flexible office sizes: Choose from small, medium, or large offices.

- Warehouse Options

- Various sizes available: Pick a warehouse that fits your storage needs.

- Climate control: Some warehouses offer temperature-controlled environments.

- Loading docks: Facilitate easy loading and unloading of goods.

- Storage solutions: Shelving and pallet racking options enhance organization.

- Proximity to ports: Warehouses near Jebel Ali Port simplify logistics.

- Various sizes available: Pick a warehouse that fits your storage needs.

Choosing the right office space or warehouse can greatly benefit your business in Jebel Ali Free Zone in the UAE.

Financial Planning for JAFZA Company Establishment

Financial planning is vital for company setup in JAFZA. You must consider initial costs and ongoing expenses to operate smoothly there.

Initial Setup Cost Analysis

JAFZA business setup requires careful financial planning. Here is a summary of the initial setup costs.

| Cost Component | Amount (AED) |

| Business Registration Fee | 3,500* & upwards* |

| Trade Name Reservation | 500* |

| License Fee (varies by type) | 5,000* & upwards* |

| Office Space (annual) | 15,000* & upwards* |

| Warehouse (annual) | 70,000* & upwards* |

| Visa Fees (per visa) | 3,000* minimum |

| Share Capital Requirement | 100,000** |

| Miscellaneous Fees | 2,000* – 5,000* |

Ongoing Operational Expenses

Ongoing operational expenses for a company in Jebel Ali Free Zone can vary based on different factors such as the type of business, size, and facilities required. The table below outlines some of the common operational expenses you might encounter.

| Expense Category | Description | Estimated Cost (Annual) |

| License Renewal | Annual renewal of the business license | $1,500* & upwards* |

| Office Space Rental | Renting office space within JAFZA | $10,000* & upwards* |

| Warehouse Rental | Leasing warehouse facilities | $15,000* & upwards* |

| Utilities | Annual cost for electricity, water, and internet | $5,000* – $20,000* |

| Employee Salaries | Annual salaries for local and expatriate employees | $30,000* & upwards* |

| Maintenance | Routine maintenance of office and warehouse | $2,000* & upwards* |

| Insurance | Insurance for property, employees, and operations | $3,000* & upwards* |

| Marketing and Advertising | Annual budget for promotional activities | $5,000* & upwards* |

| Compliance Costs | Annual costs for legal and regulatory compliance | $1,000* & upwards* |

Conclusion

Setting up a business in JAFZA is smart and easy. You get many benefits like tax exemptions and strategic location perks. With various company options, you can find what fits best for your needs.

The digital process makes everything smooth and fast. Ready to grow? Start your journey in JAFZA today and if you are stuck anywhere, connect with us. We at Xpert Advisory are always there for you.

FAQs

1. What is the process for setting up a limited liability company (LLC) in Jafza?

The business setup process for an LLC in Jafza includes obtaining necessary licenses, securing work permits, and ensuring asset protection.

2. Are there any taxation benefits for companies established in Jafza?

Yes, companies in Jafza often enjoy favorable taxation policies which can benefit both public and privately held companies.

3. How do I calculate end of service benefits for employees?

You can use a gratuity calculator to determine the end of service benefits based on UAE regulations.

4. Can my company go public with an Initial Public Offering (IPO) after setup in Jafza?

Yes, your business can transition from being a privately held company to a public company through an Initial Public Offering (IPO). Keep in mind that is subject to relevant approvals,

5. What are some essential requirements regarding inventory management in Jafza?

Proper inventory management involves maintaining accurate records and complying with local regulations set by the UAE authorities.